A simple internet search quickly shows the biggest exporters of soy, coffee, cattle or iron ore. But there is a strange silence when it comes to gold: presidents of institutions in the sector say they do not know the exporters; the Federal Revenue Service and the Central Bank claim tax confidentiality.

The mystery surrounding gold exports has been broken by an exclusive Repórter Brasil investigation that sheds light on the largest exporter of gold from Brazilian wildcat mines known as garimpos. It reveals that part of the gold exported by the company may have illegal origin, often clandestinely extracted from indigenous lands and protected forests in the Amazon, causing irreversible social and environmental damage.

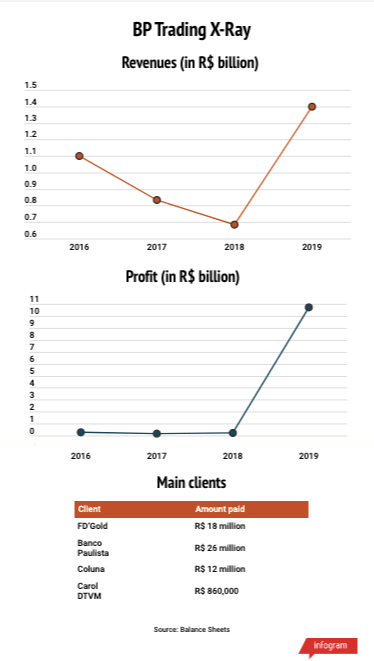

BP Trading saw exponential growth in the last two years, with revenues of R$ 1.4 billion in 2019 and whose founders were investigated under the Car Wash Operation. They are accused by the Federal Prosecution Service (MPF) of laundering money when they worked at Banco Paulista – a bank that has close links with the trading company with the same initials.

When contacted, BP Trading stated that “it maintains strict controls over the origin of the mineral purchased from its suppliers.”

An analysis of BP’s financial statements reveals that the company’s main clients include two so-called Security Distributors (DTVMs), that is, financial companies authorized to purchase gold) accused by the Federal Prosecution Service of trading illegal gold extracted in Pará: FD’Gold and Carol DTVM.

These two DTVMs, together with Ourominas, are the main buyers of illegal gold, accounting for more than 70% of all illegal or potentially illegal product, according to a recent study conducted by the Federal University of Minas Gerais (UFMG) in collaboration with Federal Prosecutors. Of all the metal bought by these companies in 2019 and 2020 in Pará, at least 60% have no proven origin, says the study.

Based on these conclusions, the Prosecutors filed a Public Civil Action in August, asking for the activities of these DTVMs to be suspended and demanding R$ 10.6 billion as compensation for socio-environmental damages.

In addition to FD’Gold and Carol DTVM, a third supplier to the trading company is Coluna DTVM, which was targeted by the Federal Police for acquiring gold from illegal mining sites, as shown exclusively by Repórter Brasil in partnership with Amazônia Real. In an investigation published in June – when we revealed how the gold that leaves the Yanomami Indigenous Territory is illegally purchased by middlemen and DTVMs, and may end up in large Brazilian jewelry stores, such as HStern.

Illegal gold extracted from clandestine mines or protected areas – a practice that is banned by Brazilian law – is “legalized” when DTVMs buy the product. Sellers fill out a paper invoice declaring the origin of that gold – fraudsters can say that it came from a legal mine, even when that is not true. The problem is that Law 12844/2013, which regulates the purchase, sale and transport of gold in Brazil, states that gold sales are based on sellers’ good faith – thus exempting buyers from any responsibility.

BP leads exports of gold from wildcat mines, but it is not the largest exporter in Brazil. The leaders are big mining companies such as Anglogold Ashanti and Kinross – which operate throughout the entire supply chain, from extraction to export. BP operates only in exports, purchasing gold from DTVMs, which, in turn, buy it from – legal or illegal – miners.

BP accounted for about 10% of sales to foreign customers in the last two years, as pointed out by Repórter Brasil, in a market that exported 202.6 tonnes (US$ 8.6 billion) in 2019 and 2020. According to the company, its main customers are in Canada and England.

Concentrated market

This supply chain of gold from wildcat mining is related to the National Gold Association (Anoro), since these three DTVMs and BP Trading seat on its board and are active participants in its assemblies, according to new documents obtained by Repórter Brasil.

The report found at least two direct links between BP and Anoro’s president Dirceu Frederico Sobrinho – who began his career in the industry as a wildcat miner and has strong connections in the upper echelon of Jair Bolsonaro’s government. A company owned by Sobrinho – FD’Gold – supplies gold while another one refines it for BP Trading: that is Marsam Refinadora, whose partners are Sobrinho and his daughter. Marsam is also a member of Anoro’s board.

“It’s important to pay attention to how concentrated the irregularities are. A few actors control them,” says UFMG researcher Raoni Rajão, responsible for the most recent and relevant study on illegality in the sector. “We are talking about few actors controlling mining processes: only six mining site owners account for more than 60% of the gold without declared origin, while only three DTVMs buy more than 70% of that potentially illegal metal.” According to the Prosecution Service’s Public Civil Action, these three companies are Ourominas, FD’Gold and Carol DTVM.

Anoro did not respond to Repórter Brasil’s several attempts at communication by e-mail and telephone.

Billion-dollar figures

A source connected to the sector who asked for anonymity explains how the market works. Demand for gold starts abroad, with orders placed by international buyers with trading companies. These exporters turn to DTVMs, which buy it from miners. “BP finances the supply chain [in Brazil]. It deposits the money in advance on DTVMs’ bank accounts, which, in turn, have three days to settle transactions.”

Financial analysis of these companies’ balance sheets – both DTVMs and BP Trading – shows how the latter’s results stand out. Furthermore, while illegal mines in indigenous lands mushroom and violence increases in villages – even with participation of organized crime – BP has accumulated impressive results.

While DTVMs such as FD’Gold and Carol had gross revenues of BRL 15.6 million and BRL 13.5 million in 2019, respectively, BP Trading declared revenues of BRL 1.4 billion in its balance sheet for the same year – more than twice its 2018 results (BRL 659 million). Founded in 2015 and headquartered at São Paulo’s Faria Lima Avenue, BP earned R$ 10.7 million in profits in 2019 – 73 times more than two years earlier.

In 2019, BP received the equivalent of R$ 57 million in gold, of which R$ 18 million were purchased from FD’Gold, R$ 12 million from the Coluna DTVM, and R$ 870,000 from Carol DTVM.

Another BP client and supplier deserves attention: it is Banco Paulista, which has been investigated by the Car Wash Operation for two years. In 2019, the bank traded R$ 26 million in gold with BP, according to the latter’s balance sheet.

Two former BP partners are accused of money laundering

BP Trading’s close relations with Banco Paulista are not limited to the bank being cited as its client and supplier in its 2019 balance sheet. BP was founded in 2015 by Álvaro Augusto Vidigal (whose family created Banco Paulista and who has a long history in the financial sector) and by Tarcísio Rodrigues Joaquim, then the bank’s foreign exchange director. In May, prosecutors accused both of organized crime, money laundering and active corruption as a result of suspicious operations in the exchange department of Banco Paulista. The charges have not yet been considered by the courts.

In early 2019, the bank was targeted by the Lava Jato operation. According to the prosecutors, Banco Paulista would have laundered R$ 48 million in funds deposited abroad and belonging to construction company Odebrecht. During a Federal Police operation, three directors of Banco Paulista were arrested – including Tarcísio Joaquim – but released a month later.

Brazil’s Central Bank also fined Banco Paulista almost R$ 10 million last year “for failing to report abnormal/atypical movements of funds to the Council for Financial Activities Control (Coaf),” among other violations.

As a result of the investigations, fines and lawsuits, Vidigal and Joaquim left BP Trading in 2019, opening the way for Francisco Ferreira Junior and Ernesto José dos Santos to take charge of the company. Current director Ernesto Santos has also been investigated for money laundering when he was a partner at Zera Promotora, suspected of being part of the scheme with Banco Paulista and Odebrecht. Despite investigations pointing out that he would have received R$ 17 million in fake contracts, Santos was not charged by the Paraná Prosecution Service.

The downfall of Banco Paulista after the Car Wash Operation led several of the bank’s employees to migrate to BP Trading, especially with the closure of the bank’s foreign exchange desk, thus strengthening BP’s operations. The current president of BP Trading, Francisco Ferreira, used to hold a management position at the bank. At least six other former Banco Paulista employees currently work at BP, including directors, supervisors and managers.

Vidigal – the former BP partner – has businesses in a variety of segments, including financial brokerage firms. He and Francisco Ferreira Junior, current director of BP Trading, were partners with Anoro’s president Dirceu Sobrinho at refiner Marsam Metais. The partnership started in early 2020 and was dissolved in May this year.

Through his lawyers, Vidigal said on a note that he had decided to step down from Banco Paulista’s board of directors for personal reasons. About the charges filed by the Prosecution Service, he denies any involvement in the crimes and said he is confident he will be acquitted.

Also through his lawyers, Tarcísio Joaquim stated that he owned only 1% of BP Trading and that he has not been a partner since May 2019. He adds that he has never held any management or administration position in the company. Ernesto José Santos could not be located for comments.

On a note, BP Trading said that the increase in the company’s profits is linked to “market factors” such as supply, price and scale. The company also stated that it is “a necessary condition for its operations that the gold is accompanied by legally required documents.” BP also said that “Banco Paulista is just one of the banks in which it has a checking account”.

FD’ Gold limited itself to saying that “it does not know the content of the lawsuit and the object of the charges [filed by the Prosecution Service].” Carol DTVM stated that it only buys gold from mining sites authorized by the National Mining Agency.

Ourominas said that it has a “strict internal control system” to prevent purchase of illegal products and that it has not seen the lawsuit’ records. Read the full answers here.

Using the Access to Information Act, Repórter Brasil unsuccessfully tried to obtain a complete list of the largest gold exporters in the country as well as the main foreign buyers – the Federal Revenue and the Central Bank claim confidentiality. Organizations in the sector do not know, will not speak or will not reveal names. Anoro did not respond to several attempts at communication.

“We don’t know those companies’ names, the destination of their exports, or their buyers. Everything is protected by confidentiality. In the end, we have no information about gold exports in Brazil,” complained José Augusto, president of the Brazilian Foreign Trade Association, about the industry’s lack of transparency.

If DTVMs are sourcing gold from illegal mining sites, they are also contaminating the exports with the illegal product. The problem is that, under the current legislation regulating the sector, sellers are responsible for declaring the origin of the gold. That is, illegal gold is “laundered” before reaching DTVMs. That is a serious problem of product traceability whose solution involves creating a new mechanism for declaration of origin, such as electronic invoices, as advocated by some organizations in the sector.

“We are considering ways to tackle this problem, improve inspections, advance legislation and prevent this illegal gold from continuing to circulate and therefore from being exported,” says the director-president of the Brazilian Mining Association, Flavio Ottoni Penido. While nothing is done, traditional peoples living in the Amazon succumb to forest destruction, contamination of rivers by mercury, and division of their villages.

*Maurício Angelo contributed

Note: This text was updated on October 21, 2021 at 6:01 pm to include Tarcísio Rodrigues Joaquim’s stance.”